For Daily Job Alert For Daily Job Alert |

Join Our Whats App Channel |

For Free Study Material For Free Study Material |

Join Our Telegram Channel |

INROADS (Indian Risk-Oriented and Dynamic Rating System)

The Reserve Bank of India (RBI) has decided to change the way it monitors and supervises banks in order to make the process more forward-looking. The move comes against the backdrop of the risks that have emerged after the global financial crisis of 2008, with lenders shifting from offering traditional products to more complex ones.

The country’s financial sector would now be evaluated under a dynamic risk-based mechanism, an aspect the present CAMELS rating system lacked, central banking sources said. RBI proposes to replace CAMELS with INROADS (Indian Risk-Oriented and Dynamic Rating System) from the next round of annual financial inspection, in 2013.

At present, the central bank uses the CAMELS (Capital adequacy, Asset quality, Management, earnings, Liquidity, and Systems and control) method, to assign ratings to Indian banks. CAMELS, which goes from A+ to D is assigned to a bank while finalising the annual financial inspection (AFI) report.

| CHANGING TACK The changing landscape of banking supervision |

|

Evolution of banking Supervision- from Rule based to Risk based

Traditionally, the principal focus of banking supervision was on ensuring that banks adhere to a set of prescribed rules. This is called the Rule based approach, wherein the bank is supervised under static performance measures. Till 1970’s this was the common standard followed globally for rating the banks, when the banks were pre-dominantly deposit-taking and loan-making institutions. The key risk then was credit risk which arises due to the probability of the borrower failing to repay. However, deregulation in the 1970s and 1980s in different parts of the world led to growth in off-balance sheet items, complex financial products and boundaries blurring between banks and other financial institutions. This led to identification of operational, market and liquidity risks for which the traditional approach was modified to include broader parameters like management efficiency, Liquidity and Sensitivity. This came to be known as CAMELS (CAMEL till the introduction of new parameter “Sensitivity” or “System and controls” in 1995 thus baptising it as CAMELS).

As cross-border transactions increased, banks started playing a major role in international trade which increased the inter-dependency of banks of different countries. In 1988, the Basel Committee of Banking Supervision came up with the Basel Accords (Basel-I) which suggested a standard framework of supervision for the G-10 countries based on two pillars: Capital and Asset. The committee revised the framework in response to global needs to come up with Basel-II which is currently followed worldwide. Basel II came with the revolutionary concept of banking supervision being “contextual” rather than “uniform”. The Basel Core Principle 8 states:

“An effective system of banking supervision requires the supervisor to develop and maintain a forward-looking assessment of the risk profile of individual banks and banking groups, proportionate to their systemic importance; identify, assess and address risks emanating from banks and the banking system as a whole; have a framework in place for early intervention”.

It was observed that though modern version of CAMELS captured most aspects of the globally emerging trends in the industry, in present scenario it was ineffective in capturing the early warning signals of a troubled firm and being extensively compliance based, was a deterrent to innovation. Thus supervisors across the globe started to shift towards a more innovation-friendly risk based approach to supervision, pioneers being UK and Australia.

In India, however, the deregulation of banking sector came with the liberalization of 1990s when the new private sector banks, foreign banks and financial conglomerates came into existence. The CAMELS rating system for domestic scheduled commercial banks (SCBs) and CALCS for foreign SCBs was started during this time. Though the banking landscape has undergone significant changes since then, the supervisory system of India has somehow remained stagnant compared to its foreign counterparts like China, East Africa, Australia, Canada etc. which have switched to risk-based approach to supervision.

Decision of RBI to go INROADS in 2013- Is the reform necessary?

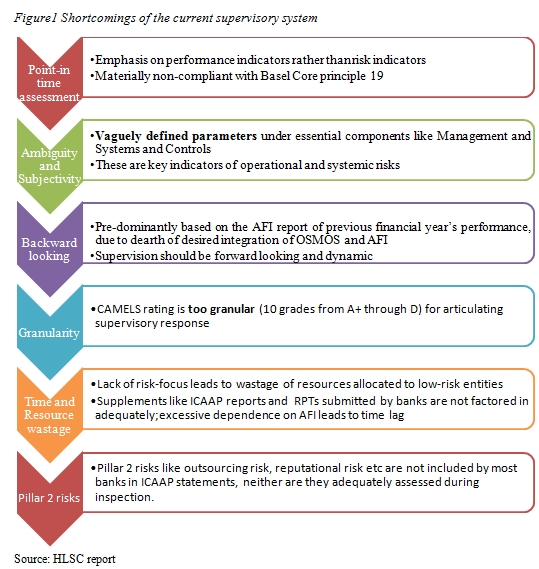

In view of the progressive deregulation of the Indian Banking system, increasing global relationships and rapid growth in the scale and complexity of the banks/financial institutions, a High Level Steering Committee (HLSC) was formed under the chairmanship of the Deputy Governor, K.C. Chakraborty to critically analyze the current supervisory structure with respect to the current needs of the system. The committee identified several shortcomings of the current system and has recommended a phased move towards RBS.

In India, banking supervision is done through off-site surveillance and monitoring system (OSMOS) and onsite supervision involving Annual Financial Inspection (AFI) which is presently modelled around the CAMELS framework for domestic banks and CALCS for foreign banks. Based on this supervisory ratings are given to the banks and a monitorable action plan (MAP) is drawn.

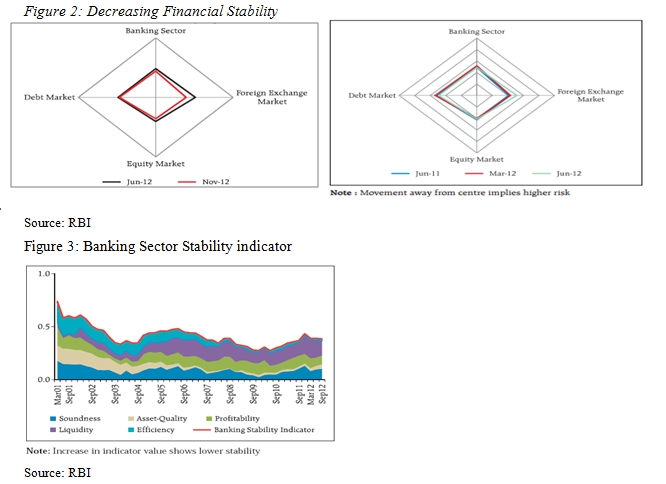

Besides this, an analysis of India’s FSAP report of the IMF (February 2012) and the latest financial stability report of RBI (December 2012) reveals that despite the strong resilience demonstrated by India in the GFC in 2008, the financial soundness indicators as well as banking stability index is on a steady decline.

This owes to some of the emerging trends in Indian banking sector which create some material risks in the system, which by far is not captured satisfactorily by the compliance based CAMELS framework:-

- Increased Cross-border activities which are otherwise beneficial for banks, increase risks which are not captured in the present CAMELS rating.

- Rising off-balance sheet exposure which increases the bank’s earnings, but also increases risk and threats financial soundness of the whole system. CAMELS rating take only a static compliance-sake measure of the percentage of off-balance sheet assets, while ignoring its trend and impact.

- Credit concentrations: Prudential limits of large exposure to a single entity are 12-25% as per international standards, while RBI has set it at 55%. Under CAMELS only compliance to the norm at the time of inspection is considered, thus allowing the banks to raise credit concentrations with associated risks unnoticed.

- Cross-category activities: Rising number of financial conglomerates has increased cross-category activities thus raising the interconnectedness and complexity of Indian financial sector.

- Money laundering is on rise, with even modern technologically banks unable to detect fraudulent activities promptly is a major concern, where current supervision has failed.

- Degradation of Asset quality is significant, and despite being an integral part of CAMELS, the root causes are not capture.

Benefits of RBS

RBS is a forward looking system which uses historical data and macro-economic factors as input and applies statistical models to evaluate riskiness of the business by projecting future contingencies. It consists of rigorous risk assessment, to evaluate likelihood of/ proximity to failure, and critical analysis of the impact of the failure. It is a structured, disciplined approach, with a “built-in” flexibility.

Table2 CAMELS v/s INROADS

| Rule Based supervision (CAMELS) | Risk Based Supervision (INROADS) |

| Transaction oriented | Process and outcome oriented |

| One-size fits it all | Proportionate |

| Static, point-in-time assessments | Dynamic, continuous assessments |

| Backward-looking | Forward-looking |

| Reactive | Pro-active, preventive |

| Incompatible with innovation | Responsive to innovation |

| Based on compliance | Principles based |

| Avoids Risk by forcing hard rules | Focus on risk control and alleviation |

Challenges and the road ahead

A pilot run for RBS was conducted by RBI for selected SCBs in 2003-04 which failed due to several reasons, most important being lack of support from the top management of banks. Thus, for RBS to be successful this time, the following pre-requisites should be sufficed:

- Awareness about significance of risk both within RBI as well as all the banks.

- Presentations on the emerging issues in banking system, and how RBS is beneficial are required both for the RBI staff and the top management of banks.

- Effective Business Information System that can not only record the daily financial and non-financial transactions but also analyze them to find potential markets, identify which products are profitable and where, which products can be eliminated, what are the high risk activities, which activities have a systemic impact etc.

- Risk based Internal Audit in banks, involving selective transaction testing, evaluation of risk management and control procedures, recommendations for mitigating risks and anticipating potential risks.

- Advanced risk management system based on sound internal models.

- Risk-based pricing of products by banks.

Switch to INROADS can be seen as a prudent and necessary decision of RBI, which will encourage innovation while maintaining financial stability. RBI’s past experience testifies that both banks and RBI are equal stakeholders in any supervisory reform, and they need to cooperate for the successful implementation of INROADS.